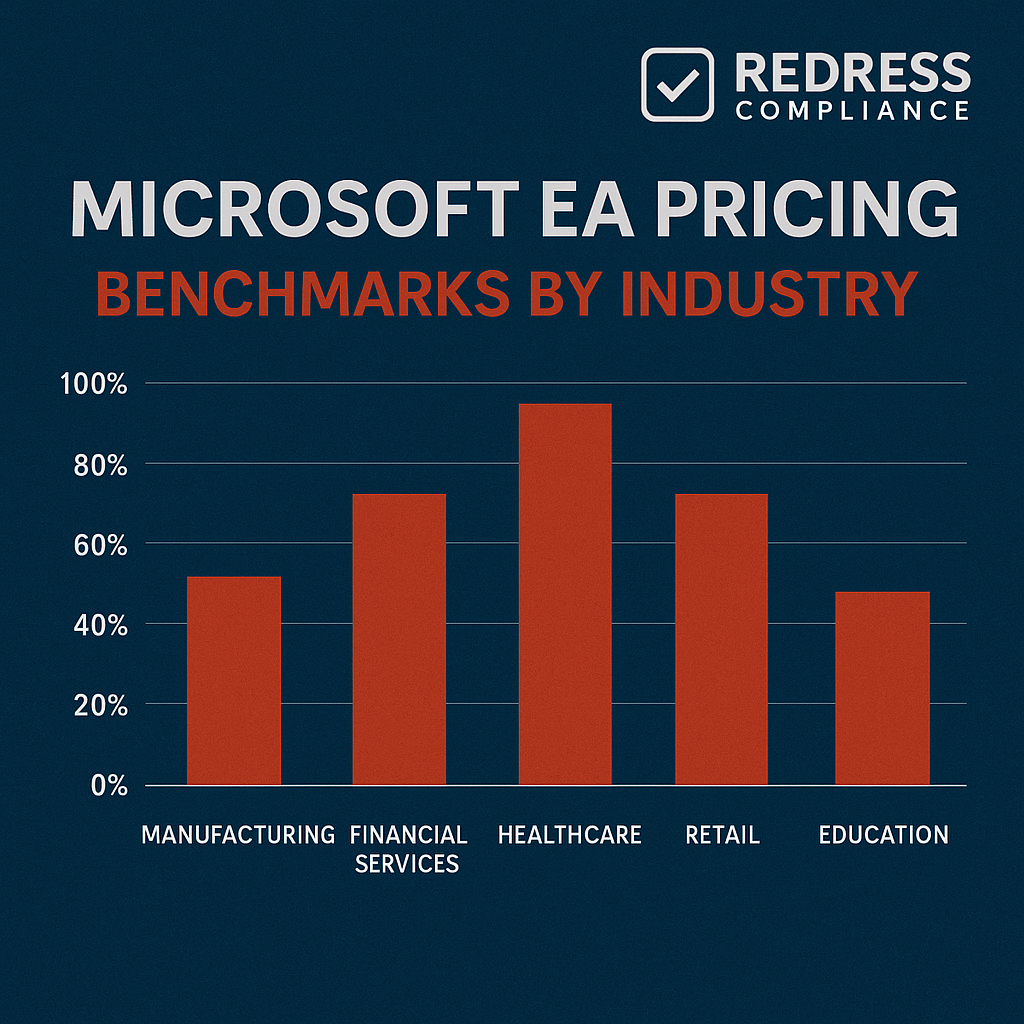

Microsoft EA Pricing Benchmarks by Industry

Microsoft Enterprise Agreement (EA) pricing benchmarks have become essential tools for CIOs, CFOs, and procurement teams as they head into 2025.

These benchmarks cut through Microsoft’s notorious opacity on EA pricing and discounts, revealing what “good” looks like for deals in your industry and company size.

With multi-million-dollar renewals at stake, too many enterprises still negotiate blind – often accepting Microsoft’s first proposal without realizing it’s overpriced relative to what others pay. Lacking insight into Microsoft EA cost benchmarks, organizations risk overpaying by millions simply because they are unaware of market norms.

By contrast, armed with solid benchmark data, enterprises can confidently push back on inflated quotes and demand fair, market-aligned pricing. Read our guide to Microsoft EA pricing.

Knowing the benchmarks means knowing the target. Microsoft won’t volunteer that peer companies of similar size and industry routinely pay 20% less than the quote you’re being offered – but benchmark data will.

In 2025, with Microsoft aggressively upselling cloud and AI products and reshuffling its licensing models, having these reference points is more critical than ever.

Industry-specific EA pricing benchmarks let you calibrate your negotiation strategy, avoid one-size-fits-all pricing traps, and enter renewal talks with clarity on what a competitive deal truly is.

Why EA Benchmarks Matter

Pricing varies widely: Unlike sticker prices at a retail store, Microsoft’s EA pricing is not standardized. Discounts and deal terms can vary significantly by region, industry, and a customer’s negotiating leverage.

Microsoft’s list pricing is just a starting point; the real prices companies pay are all over the map. That’s why benchmarks tailored to companies of comparable size, industry, and Microsoft spend are key – they help you compare apples to apples.

Without this context, a quote that looks “reasonable” might in fact be well above what your peers pay.

Negotiating blind is costly: Without benchmarks, enterprises are essentially flying blind into EA negotiations. Microsoft’s sales teams take advantage of this information asymmetry.

The company’s initial EA proposals often hew close to list prices or only modestly below, banking on customers’ lack of market context. If you don’t know what other enterprises are paying, you’re at high risk of accepting an inflated offer.

In practice, the “best offer” in Microsoft’s first quote is seldom best-in-class – for example, a customer might get only a 5% discount while similar peers receive 15–20% off.

This gap is your savings opportunity. Benchmarks shine a light on these discrepancies so you don’t unknowingly leave money on the table.

Insight into typical discounts: Benchmark data provides visibility into the typical discount ranges achievable for various EA components, including Microsoft 365 “online services” seats, Azure cloud commitments, and Software Assurance benefits.

For instance, large enterprises have historically enjoyed built-in volume discounts (Levels A–D) on Microsoft 365 licenses, often 15–40% off the list price, depending on size, plus additional negotiated concessions for strategic accounts.

Similarly, Azure spending commitments might come with 10–15% effective discounts via upfront discounts and credits. Benchmarks let you gauge if Microsoft’s offer on each piece – be it Office 365, Azure, or support – is in line with what’s typical for a company of your profile. This knowledge is power: it shifts the conversation from “Here’s your price” to “Here’s what the market price is”.

In short, EA benchmarks prevent overpaying. They replace guesswork with data.

With benchmarks, you enter negotiations armed with facts to challenge Microsoft’s narrative, ensuring your EA renewal is based on peer-aligned pricing rather than Microsoft’s opaque “trust us” quotes.

Given Microsoft’s complex, ever-changing licensing landscape, benchmarks are the compass that keeps your negotiation on course toward a fair deal.

Read more about pricing models, Read Hidden Costs in Microsoft EA Contracts: What to Catch Before You Sign..

Microsoft EA Pricing Trends in 2025

The year 2025 is a turning point for Microsoft’s enterprise licensing, marked by major pricing shifts and new pressures that savvy customers must understand.

Global pricing patterns are changing, often in ways that erode customer advantages:

- End of volume discounts: Microsoft is eliminating volume-based discounts for online services under EAs starting November 1, 2025. The traditional tiered pricing (Levels A through D) – where larger organizations automatically got lower unit prices – is going away. After this change, all customers pay “single-level” pricing by default, no matter if you have 500 seats or 50,000. This is a seismic shift: enterprises can no longer count on size alone to guarantee better pricing. It puts more onus on negotiation to secure discounts, since Microsoft won’t “hand them to you” for volume anymore. The removal of automatic volume discounts means pre-negotiation EA quotes in 2025 may come in significantly higher (Microsoft itself warns total cost could jump ~25% at renewal if you do nothing). Negotiated concessions will increasingly hinge on factors such as committed spend and strategic product adoption, rather than just scale.

- Tighter discounting on cloud products: Microsoft’s discount generosity has been tightening, especially for cloud services. For example, Azure consumption deals now often yield only modest savings unless you negotiate aggressively. It’s not uncommon to see Microsoft’s first Azure offer mirror pay-as-you-go rates or give perhaps a 5% baseline discount for a certain spend. Still, well-informed customers know peers committing similar cloud budgets get closer to 10–15% off via combined discounts and credits. In short, Microsoft isn’t freely giving the deep cloud discounts it might have in years past, partly because it knows customers are shifting to ongoing consumption models. Every percentage on Azure now has to be fought for, often by leveraging competitive alternatives (AWS, Google) as bargaining chips. The same goes for other online services: Microsoft’s overall discount patterns have shrunk; they tend to save the best deals for end-of-quarter or year-end negotiations to hit sales targets. This means timing and leverage matter more to get those last-mile discounts.

- Aggressive pricing on Copilot and AI bundles: 2025 is the year Microsoft’s new AI offerings (like Microsoft 365 Copilot) enter the EA scene, and they come with aggressive pricing tactics. Microsoft 365 Copilot is officially priced at $30/user/month (or $360/year) with no built-in volume discount – a one-size-fits-all price. Whether you have 500 users or 50,000, Microsoft initially pitches Copilot at the same steep rate, which many consider Microsoft’s priciest product rollout to date. This “flat” pricing is deliberate: Microsoft is testing the waters on eliminating tiered pricing, using Copilot as the spearhead. However, Microsoft is also extremely eager to drive Copilot and AI adoption, so behind the scenes, they have been offering selective discounts and incentives for early enterprise adopters. Reports indicate discounts ranging from 10% to 40% on Copilot licenses for large customers willing to be reference cases or to make big, upfront commitments. Microsoft even bundled Copilot at no extra cost for one year as part of a major U.S. government deal. The takeaway: Microsoft’s strategy is to price AI high on paper, but make strategic concessions to those who push – meaning the list price is not the final word if you have leverage. Expect AI bundles to be dangled in your EA renewal, and expect Microsoft to push hard for enterprise-wide adoption. They may position bundles as a great “deal,” but it’s on you to dissect the true cost of each component and demand fair pricing (or pilot programs) for these unproven new tools.

- EA renewal dynamics and alternatives: The landscape of EA renewals is being reshaped by alternative licensing channels such as the Cloud Solution Provider program and the newer Microsoft Customer Agreement for Enterprise (MCA-E). Microsoft’s move to standardize pricing and reduce EA perks is partly aimed at nudging customers to these modern, flexible channels. From a customer perspective, CSP/MCA-E can introduce more competition and flexibility into your negotiation. These channels allow month-to-month or annual subscriptions and easier “scale down” of licenses. In contrast, a traditional EA locks you into a three-year term with limited annual reduction rights. The ability to threaten a move to CSP/MCA-E if EA pricing isn’t competitive has become a key lever. Microsoft knows that if it refuses to meet a customer’s benchmark price expectations, the customer can switch some purchases to CSP or opt for a shorter-term MCA deal. In fact, with the end of volume discounts, the price gap between EA and CSP is closing – making an EA less automatically attractive. We’re seeing enterprises use this in two ways: either as a negotiation chip (“match these benchmark discounts or we’ll consider a CSP split for certain workloads”), or in some cases, actually transitioning away from EAs for portions of their spend to maintain flexibility. The result is added pressure on Microsoft to offer more bespoke discounts or value-adds in EAs to justify the 3-year lock-in. In 2025’s renewals, expect Microsoft to emphasize things like long-term price protection or larger multi-year cloud credits to keep customers under EAs, while customers should keep the option of alternative channels in their back pocket for leverage.

- Industry-specific discount pressures: How these trends play out varies by industry (details in the next section). For example, financial services firms face Microsoft’s heavy E5 upsell due to compliance needs, but also have the clout to negotiate better deals. Healthcare organizations are extremely cost-sensitive and often push back on broad E5 or Azure adoption, whereas manufacturing companies juggle large frontline worker licensing needs, which brings its own discount dynamics. Technology sector companies often jump on new features like Copilot early, yet their savvy procurement teams extract concessions in return. And public sector entities might be bound by pre-set agreements, but can achieve surprisingly steep discounts when they aggregate demand (as seen in the federal OneGov deal). In all cases, understanding your industry’s norm in 2025 — what discount percentages and deal structures similar organizations are getting — will help you focus your negotiation on the right targets.

In summary, the EA pricing environment in 2025 is more challenging and complex. Microsoft is trimming away automatic discounts and betting on new high-value products.

Still, informed customers can counter this by leveraging market data, competitive options, and a willingness to walk away from the traditional EA if necessary.

The next sections break down how different industries are faring under these conditions and how you can use benchmarks to your advantage.

Industry-Specific EA Cost Benchmarks

While every enterprise is unique, there are clear industry patterns in Microsoft EA pricing and discounts. Microsoft’s sales approach – and the leverage customers have – can differ greatly between a bank, a hospital system, a manufacturer, a tech firm, or a government agency.

Here we highlight key trends and benchmark insights for major industries:

Finance (Banking & Financial Services)

License mix & adoption:

Financial services firms have been heavy adopters of Microsoft 365 E5 due to stringent compliance and security demands. Banks and insurers often need the advanced security, compliance, and analytics features in E5 to meet regulatory requirements (e.g., audit trails, threat protection, data loss prevention).

As a result, it’s not uncommon for finance companies to target a majority of users on E5, or at least all knowledge workers and regulated roles. However, this high adoption also means high spend, which gives finance sector customers significant leverage. They are typically large organizations with multi-million-dollar EAs, and Microsoft is keen to keep them happy (and not flee to competitors).

Typical discounts:

Benchmarks indicate that financial institutions can achieve above-average discounts on Microsoft 365 and Azure, given their scale and negotiation posture.

It’s typical to see double-digit percentage discounts on M365 in finance – often in the 15–25% off range for E3/E5 licenses, especially when the customer threatens to stay on lower editions or to use best-of-breed third-party tools instead of Microsoft’s upsells.

One dynamic in this sector is that many banks have viable alternatives or the budget to deploy non-Microsoft solutions if a deal isn’t favorable – for example, some large banks have experimented with Google Workspace, or use separate security suites instead of Microsoft’s E5 security bundle.

Microsoft is aware of this, so it tends to be more flexible with pricing for savvy financial firms. On Azure, finance industry benchmarks vary: many firms are still hybrid (with significant on-premises infrastructure), but those embracing the cloud aim for 15–25% off Azure consumption via large, committed spends.

Microsoft often counters the multi-cloud threat by offering extra Azure credits or custom pricing in financial sector deals, since banks can and will leverage AWS or other clouds if Azure isn’t cost-competitive.

In short, finance can secure strong discounts by playing on Microsoft’s fear of losing wallet-share; the bigger your spend, the better your bargaining position.

Negotiation nuances:

Financial enterprises should use benchmarks to push back on “standard” pricing claims. If Microsoft says “this is the industry norm,” many banks can counter with data: for instance, if peers are paying $X per E5 seat and your quote is higher, call it out.

Also, watch out for Microsoft pushing bundles (like adding Power BI, Copilot, etc.) under the guise of “digital transformation” – ensure each component’s price is benchmarked. Finance companies are often targeted for early adoption of new tech (AI, compliance tools) due to their budgets.

Still, they can negotiate pilot programs or milestone-based rollouts instead of paying for everything Day One. Finally, compliance-related add-ons (e.g. eDiscovery tools, audit logging, etc.) might be offered at low or no cost in competitive deals – check if peers negotiated those in.

The finance industry’s best negotiators leverage their importance to Microsoft (big reference customers, big spenders) and will openly pit Microsoft against competitors (both in tech and in pricing). The result can be very favorable EA terms – but only if you know what to ask for.

Healthcare

License mix & adoption: Healthcare organizations (hospitals, health systems, pharma) tend to be cost-sensitive and selective in adoption of Microsoft’s top-tier licenses. Many healthcare providers primarily use Microsoft 365 E3 for knowledge workers, with a limited deployment of E5 for users handling highly sensitive data.

Budget pressures in healthcare mean they scrutinize each upgrade – for example, a hospital may only license E5 for its security team and compliance officers, rather than for all doctors and nurses.

Healthcare also often employs many shift-based or frontline staff (clinicians, support staff) who may use cheaper licensing (such as Microsoft F3 or former E1 plans) just for email and basic collaboration.

This mix leads to very uneven license usage, which can complicate benchmarks – a health system might have a portion on E5, a large base on E3, and hundreds or thousands on Frontline/F3.

Typical discounts: Price sensitivity is high in this sector, so even moderate discounts can make or break a deal. Industry benchmarks show healthcare enterprises typically achieve 10–20% discounts on Microsoft 365 licenses, sometimes more on certain components if they can demonstrate budget constraints.

Microsoft knows that healthcare margins are tight, but it also knows that they can be long-term customers once locked in, so it offers concessions.

For example, some hospitals have secured extra licensing grants or discounted rates for clinical staff licenses to fit under budget caps.

On Azure, Microsoft often encourages healthcare organizations to commit to cloud services (for data analytics, patient portals, AI for imaging, etc.), but many healthcare organizations proceed cautiously.

Azure discounts in this vertical might land around 10–20% as well for those that commit (with higher potential if a healthcare provider is considering a rival cloud for electronic health record hosting, for instance).

However, suppose a healthcare customer isn’t fully committed to the cloud yet. In that case, Microsoft’s leverage is lower, and they might instead bundle Azure credits as a sweetener for future use rather than give big immediate discounts.

Negotiation nuances:

Healthcare IT and procurement leaders should use benchmarks to identify where they might be overpaying relative to peers, then frankly explain to Microsoft that budgets are constrained.

One effective tactic is referencing how other healthcare providers achieved X savings – for example, citing a peer hospital network that negotiated a 20% overall EA cost reduction by right-sizing licenses and securing better pricing.

Microsoft’s reps often try upselling E5 and new AI tools (e.g., AI-powered diagnostic support via Azure) in this sector, but healthcare can push back by piloting these in limited settings.

Selective adoption is your friend – don’t let Microsoft assume a blanket rollout. Use benchmarks to show that many healthcare organizations take a phased approach (e.g., only 25% of users on E5) and therefore expect custom pricing that reflects a mixed license profile, not an all-E5 scenario.

Additionally, be aware of Azure consumption commitments: Microsoft might pressure for a big Azure commitment as part of the EA, claiming “many in healthcare are moving to the cloud.” If your benchmarks or industry intel say otherwise (e.g., most peers only commit to small Azure deals initially), use that to negotiate a smaller commitment or more flexibility (like opt-out clauses if regulatory issues prevent cloud migration).

In summary, benchmarks in healthcare can justify a frugal, phased approach – proving to Microsoft that you know what a fair deal looks like for a cautious, budget-bound healthcare organization.

Manufacturing

License mix & adoption: Manufacturing companies usually have a mixed workforce of office-based and frontline workers, and their Microsoft licensing reflects that. It’s typical to see a minority of users on E5, a substantial portion on E3, and a large number on Frontline (F-series) licenses for factory and field workers.

For example, a global manufacturer might license its corporate staff on E3 or E5, but use F3 (formerly Office 365 F1/F3) for thousands of shop floor employees who only need email, Teams communication, or shift scheduling.

This creates an EA where per-user costs vary widely – an F3 license is far cheaper than an E5. Benchmarking manufacturing EA costs means accounting for this license mix.

A company with 10,000 factory workers on F3 and 2,000 on E3 will have a significantly lower average cost per user than a software company with 12,000 employees all on E3/E5.

Typical discounts:

Manufacturers historically benefited from volume discounts due to their often large headcounts, but with those automatic discounts ending, negotiated discounts now carry more weight. Generally, manufacturing firms can achieve discounts of 10–20% on Microsoft 365 components.

Microsoft 365 E3/E5 pricing for a manufacturer with tens of thousands of users may come in ~20% below the list price through hard negotiation (especially if they threaten to license only a bare minimum or use Google for some collaboration needs).

On Frontline licenses, Microsoft’s wiggle room is a bit less (those are already low-cost). Still, large deals have seen Microsoft offer special pricing or promotional deals for frontline workforce tools to win big manufacturing clients.

For instance, Microsoft might bundle in Viva or Teams upgrades for the frontline at a discount to drive usage. On the Azure side, manufacturing companies vary – some are heavy on IoT and analytics (thus big Azure spend), others are just dabbling.

When Azure is involved, Microsoft often uses it as a bargaining chip. If the manufacturer commits to Azure for IoT or ERP workloads, Microsoft will extend higher discounts in other areas. Azure discounts in manufacturing deals can be 15–25% if the customer is moving industrial workloads to Azure, since Microsoft fiercely competes with AWS for IoT/industrial cloud wins.

If cloud isn’t a focus, the EA might be more about Windows, Office, and Dynamics (for ERP like Dynamics 365 Supply Chain) – those should be benchmarked individually (e.g. what discount did a peer get on Dynamics seats).

Negotiation nuances:

Key leverage for manufacturing firms is their global footprint and alternative options for certain segments.

They can say, for example, “If Microsoft doesn’t align with market pricing, we have the scale to explore other solutions for our frontline communications” – even if switching from Microsoft is unlikely, the threat can be credible when thousands of users are in play.

Use industry benchmarks to set expectations: e.g., “Our peers in manufacturing with similar-sized deals are paying $X per E3 user; we need to be in that ballpark.” Also, highlight if your industry peers received special concessions. Perhaps another manufacturer got a flat renewal (0% increase) despite Microsoft’s price hikes, or got extra training days and support included – bring these up.

Microsoft often pushes upsell pressure points, such as upgrading the remaining base of E3 users to E5 (“security is critical for factories too!”) or adopting new AI-driven quality control tools. Negotiation tip: Tie any acceptance of an upsell to better pricing.

For example, “We’ll consider a pilot of Copilot for our engineering department, but only if you improve the discount on our core Office licenses to industry-standard 20% off.” Microsoft’s desire to penetrate new product areas in manufacturing (IoT, AI, etc.) can be turned into leverage to improve the core deal.

Finally, manufacturers should benchmark Software Assurance and support terms too – large enterprises in this sector often negotiate things like training vouchers for factory IT staff or fixed pricing on Unity (Unified) Support, knowing what other firms have secured.

The bottom line: use your scale and industry examples to insist on a lean, efficient deal, because manufacturing operates on thin margins, and Microsoft is aware of that reality.

Technology Sector

License mix & adoption: Tech companies (software firms, IT services, etc.) are often early adopters of Microsoft’s latest products – but also quick to question the value.

Many tech organizations have a high percentage of knowledge workers and developers, so they might lean toward Microsoft 365 E5 to get all the advanced features (security, Power BI, voice, etc.) for their tech-savvy staff.

At the same time, tech companies are the most likely to mix and match tools: they might use GitHub extensively (Microsoft-owned, but separate), or alternative developer tools, and they tend to be cloud-native (using Azure, but also AWS/GCP).

So a typical tech firm’s EA might include a lot of E5, but also custom dev tools and significant Azure consumption. It’s not uncommon for a tech company to forgo some Microsoft pieces if they have in-house solutions (e.g., using Slack instead of Teams, or a custom data platform instead of Power BI). This gives them negotiating power.

Typical discounts:

The technology sector, particularly larger firms, often secures some of the best EA discounts. Partly because they know how to play the game, and partly because Microsoft sees them as high-influence customers (or even partners).

It’s not unusual for savvy tech companies to aim for 20%+ off M365 E5 licenses, for example, by demonstrating that they could stick with E3 plus their own security tools if the E5 price isn’t cut.

Tech companies also leverage their internal expertise: they come to the table armed with market intel (perhaps even ex-Microsoft employees on staff who know deal benchmarks!).

On Azure and other cloud services, tech firms that commit heavily can negotiate very aggressive rates – especially if they have a multi-cloud strategy.

Benchmarks show that Azure discounts in tech deals can reach 20–30% or more, but this often involves significant spending commitments and even co-marketing agreements (Microsoft loves having logos of born-in-the-cloud companies as references).

Also, many tech firms get startup credits or partner incentives that effectively discount their Azure usage. Microsoft 365 discounts in tech are strong too because these companies will pilot things like Copilot early – Microsoft may give them promotional pricing (e.g., first X months free or an introductory discount) to gather success stories.

Negotiation nuances:

Tech companies should use their competitive awareness and willingness to innovate as a negotiation tool. Microsoft knows a tech firm might actually rip out their product in favor of a competitor or open-source alternative if provoked – this fear can be used to your advantage.

When negotiating, name-drop alternatives: e.g., “Our dev teams could just use Google Workspace if Teams and Office 365 costs become unreasonable,” or “We’re comparing Azure against AWS for this next project, so we need Azure pricing to reflect that competitive reality.”

Internally, gather benchmark data from your network – tech folks talk to each other, and it’s common to hear what discounts others received. Use that data: “We know from the market that 25% off E5 is achievable, and we won’t settle for 10%.”

Also, keep an eye on Copilot/AI negotiation in tech. Since tech sector companies are among the first to deploy AI broadly, Microsoft might push you for an enterprise-wide Copilot purchase. If the price is too high, counter by pointing out that not every role needs it, and other companies are starting with small pilot groups.

Perhaps cite that “most companies are not rolling out Copilot to 100% on day one – they’re negotiating pilot discounts” (indeed, many are doing just that).

Tech firms can often negotiate flexible terms like shorter contract durations or opt-out clauses, because Microsoft knows they’ll scrutinize value continuously.

If you have in-house developers, consider negotiating GitHub Advanced or Azure DevOps deals concurrently – bundle them into your EA negotiation and benchmark those prices too (many tech companies got GitHub seats included at reduced cost as part of broader EAs).

In essence, leverage the fact that your organization understands technology deeply; Microsoft can’t bluff easily on “value” arguments if you have data.

That savvy, combined with knowing peer deals, means you can extract highly favorable pricing – something Microsoft expects from this sector’s customers.

Public Sector

License mix & adoption: The public sector (government agencies, public institutions) often operates under different procurement rules and collective agreements.

Many public sector organizations buy through frameworks or group contracts (for example, a national or state-level Microsoft agreement that all agencies can use).

This can set a baseline price for things like Microsoft 365 – usually somewhat discounted from the commercial list, but not always the very lowest market price. Public sector entities often use Microsoft 365 G3/G5 (government variants of E3/E5) for compliance with government cloud requirements.

The adoption of E5 in government varies: some agencies opt for it to bolster security (important for defense, law enforcement, etc.), while others stick to G3 due to cost constraints and then layer on specific add-ons.

There’s also frequently a need for Frontline licenses in areas like education or local government (e.g., public works staff). Additionally, many public sector orgs have legacy on-prem footprints and move to the cloud more slowly, which affects Azure commitments in their EAs.

Typical discounts:

Public sector pricing is a mixed bag. On one hand, governments often get access to special pricing or programs – for example, educational institutions and many federal agencies have pre-negotiated lower rates with Microsoft.

On the other hand, those “negotiated” rates can sometimes be higher than what a shrewd commercial enterprise might achieve, because they could have been negotiated years ago or not aggressively pushed due to bureaucratic processes.

Thus, benchmarks show significant variability in achievable discounts for the public sector. As a baseline, many government or public institutions may see modest discounts, such as 5–15% off on Microsoft 365 components, under their standard agreements. But there are outliers: when a public sector customer consolidates demand or negotiates at a very high level, they can unlock steep discounts.

A case in point – the U.S. GSA’s OneGov agreement in 2025 aggregated federal agency demand to achieve massive savings, including Microsoft 365 Copilot free for one year for G5 customers and other deep concessions, amounting to an estimated $3.1 billion in savings in the first year.

While that’s an exceptional scenario (leveraging the purchasing power of the entire U.S. federal government), it illustrates that public sector deals can sometimes far exceed typical discount ranges if political and budgetary will align. For most public sector organizations, Azure and cloud spend is cautiously approached – some have strict budgets or prefer private clouds.

Microsoft may offer significant Azure discounts or grants to encourage cloud adoption in government (knowing that once on Azure, the sticky nature of cloud makes revenue steady). It’s not unusual for an agency to get extra Azure credits for pilot projects or cybersecurity tools as part of an EA negotiation.

Negotiation nuances:

Procurement regulations often constrain public sector negotiations and require demonstrating “fair and reasonable” pricing. Benchmarks are incredibly useful here as justification. Agencies can say, “Taxpayers shouldn’t pay above-market rates – and here’s data showing other sectors (or other governments) pay X% less.”

Even if you’re bound to a master contract, you can negotiate within it – for instance, asking for additional discounts on certain products for your specific agency, citing your volume or mission. Use industry benchmarks from comparable public entities: how much did a similar-sized city or a school district get in terms of discounts? Often, this info can be found via public records or shared through professional networks.

Microsoft’s reps might cite the official government agreement pricing as “already discounted,” but don’t accept that at face value if your data suggests more is possible. Also, take advantage of Microsoft’s strategic initiatives for the public sector.

If Microsoft is pushing AI in government, you might get them to throw in something like a free trial of Copilot (as GSA did) or free Dynamics 365 modules for a year – ensure you benchmark not just prices, but also any extras peers received (free services, extended payment terms, etc.). One caution: public sector buyers should check benchmarks in their specific geography, as government pricing can vary by country or region.

For example, an EU government deal might not directly compare to a U.S. state deal due to different compliance requirements and Microsoft Sovereign Cloud pricing.

Finally, remember public perception – overpaying is not just a budget issue, it’s a political one. Benchmarks give you the evidence to push Microsoft for the best available market price, so you can confidently defend the deal as a good value for citizens.

Using Benchmarks in EA Negotiation

Having industry benchmarks is only half the battle – you need to use them strategically during your EA renewal negotiation.

Here are practical ways to leverage benchmarks for a better outcome:

- Identify your benchmark range: Before negotiations, pinpoint the typical discount or price range for an EA of your profile. For example, know the industry-standard discount percentage for your Microsoft 365 plan and Azure commitment. If companies of similar size in your industry get, say, 20% off E5 and 15% off Azure, that’s your benchmark. This becomes your negotiation anchor. Microsoft’s first offer will often be lower; your job is to bring the conversation toward that benchmark range. If your renewal proposal comes in far outside the norm (e.g., only 5% off where 20% is common), you’ve identified a focal point to press on.

- Cross-check every line item: Break down Microsoft’s quote into components and compare each to benchmark data. Look at the per-user cost of M365 E3/E5 in your quote versus what peers pay, the Azure unit rates or commit credits versus market deals, etc. This granular approach reveals exactly where you’re overpaying. Maybe the Office 365 portion is fine, but the Azure rates are 10% higher than the benchmark – now you know where to concentrate your efforts. Don’t forget to include Software Assurance renewals, support costs, and any add-on products in this comparison. Enterprises often focus on the big-ticket items but overlook the fact that, for instance, their quoted Unified Support fee might be higher than what another company with a similar spend pays. Use discrepancies as leverage: if something is above market, call it out and expect it to be improved.

- Leverage industry peer examples: It can be powerful in negotiations to (carefully) let Microsoft know that you’re aware of peer deals. You might say, “We know companies in our sector are receiving around 20% off on these licenses – our proposal is nowhere near that.” Without revealing confidential data, you’re signaling that their “trust us, this is a good deal” narrative won’t fly because you have evidence to the contrary. Microsoft representatives often become more flexible when they sense the customer has concrete benchmark figures. If they protest that your info might not be applicable, stick to your guns – the onus is on Microsoft to prove why you should pay more than the market rate. Use phrases like, “our analysis of industry benchmarks shows X, so that’s what we expect.” It reframes the discussion: they must justify any gap between their offer and the benchmark, rather than you having to justify asking for less.

- Benchmark beyond per-seat pricing: Don’t limit benchmarks to just the per-user cost of licenses. Benchmark your entire deal structure. That includes Azure consumption commitments (How much do similar companies commit to Azure, and what discount or extra credits do they get for it?), the mix of products (What’s the typical E3 vs E5 ratio in your industry?), and even contract terms (Do peers get the ability to swap products, or have price caps, etc.?). For example, if most companies of your size commit to $5M/year on Azure, but Microsoft is pressuring you to commit $8M, that’s a red flag to question. Or if peers negotiating a Copilot add-on got a 6-month free pilot, you should ask for the same. Use benchmarks to evaluate non-price terms as well: true-down rights, payment schedules, support levels. These can all be areas where Microsoft has flexibility if pushed. Essentially, approach your EA renewal with a 360-degree benchmark lens – price, volume, mix, and terms all have precedents you can cite.

- Turn benchmarks into demands: Once you’ve identified gaps, translate them into clear asks. “We need a minimum 20% discount on Office 365 E5 to be in line with our industry’s benchmark – only then will this renewal be acceptable.” Or “Our Azure unit rates need to drop by at least 10%, since we know others get that for similar spend”. Be specific. Vague requests like “we need a better price” are less effective than “we’re looking for $X per user, because that’s what a competitive deal looks like.” By anchoring your asks to real-world data, you justify them. It also helps internally; you can show your CFO that the targets you’re pushing for are reasonable, not just pulled out of thin air. Microsoft may come back and ask, “What would it take to close?” That’s your cue to table your benchmark-backed counteroffer line by line. Essentially, you’re re-pricing the proposal for them, using the market as your guide.

- Keep it factual, not confrontational: Present your case using benchmarks in a firm but collaborative tone. You might say, “We’ve done our homework and have data on what similar enterprises pay. We simply expect a competitive, market-aligned deal.” This puts Microsoft on notice that you are an informed customer. There’s no need to divulge sources or come off as adversarial; let the data speak. Often, a calm statement that “we know the ballpark of competitive pricing” is enough to change the tenor of the negotiation. Microsoft sellers may test if you really know your stuff – by holding a hard line initially – but if you stick to evidence-based requests, they will typically engage more seriously. In their mind, benchmarks make your threats more credible. They know you could walk away or escalate if the deal isn’t right, because you clearly know what “right” looks like.

- Use timing to your advantage: As noted, Microsoft tends to give better concessions at quarter-end or year-end. With benchmarks in hand, you can set your target and be willing to wait until Microsoft needs the deal booked. If early offers don’t hit your benchmark, be prepared to politely decline and say you’ll reconvene later. This requires confidence that your benchmark is valid and that you truly will walk if needed. We mention this here because benchmarks give you that confidence – you know there’s a better deal to be had (others have gotten it), so you’re less likely to capitulate early. Combine this with Microsoft’s fiscal pressures to maximize your leverage at the right moment.

In summary, using benchmarks in negotiation is about changing the frame of reference from Microsoft’s terms to the market reality. You’re no longer negotiating in a vacuum; you have an external yardstick.

By methodically comparing your quote to benchmarks, leveraging peer data as a shield, and insisting on aligning to market norms, you significantly improve your odds of an optimal EA renewal.

Modeling EA Scenarios with Benchmarks

One practical application of benchmarks is modeling different renewal scenarios to quantify potential savings and decide your strategy. By comparing Microsoft’s offer to a benchmark “fair market” scenario, you can clearly see the stakes.

Here’s how to do it:

1. Create a baseline vs. benchmark comparison: Take the proposal from Microsoft (your baseline) and then create an alternate version of the pricing based on benchmark rates. For example, if Microsoft quoted you $300 per user/year for M365 E3, but industry data for a company of your size suggests $260 per user/year is achievable, model the impact of getting to $260. Multiply by your number of users – the difference is the excess you’d pay if you don’t get to benchmark. Do this for each major component: M365 E5, F3 licenses, Azure commitments, etc. The cumulative difference often runs into millions over a 3-year term. This exercise arms you with a tangible figure, e.g., “Benchmarked pricing would save us $5 million over three years compared to this quote.” It’s a powerful motivator for internal stakeholders (and for Microsoft, if you choose to hint at it).

2. Model best-case, worst-case, walk-away: Using benchmarks, you can map out a few scenarios. Best-case – Microsoft meets or exceeds benchmark (maybe even extra concessions if you negotiate hard at year-end). Worst-case – Microsoft barely budges, and you end up at their initial offer (or you consider alternatives). And perhaps a middle-case – you land halfway to the benchmark target. Assign probabilities or at least discuss internally what each scenario means: Are you prepared to pursue an alternative like CSP or partial non-renewal in the worst-case? What’s your walk-away point? Benchmarks give that walk-away point some objectivity. If your data says “no enterprise our size pays over $100 per E5 user/month” and Microsoft won’t come below $110, you know you’re above market by ~10%. You might decide it’s worth exploring other options rather than accept that. Conversely, if Microsoft comes within a few percent of the benchmark by the end of negotiations, you might take the deal as it’s close enough. The idea is to use benchmarks to set rational guardrails around your decision-making.

3. Factor in new products like Copilot: AI, and new products can throw a curveball into modeling because there’s less historical data. However, you can extrapolate from what you know. Microsoft says $30/user for Copilot – but you know some early customers got 20% off or free trials. So model two scenarios: one where you pay the full Copilot price for, say, 1,000 users, and one where you negotiate, say, 6 months free + 20% off thereafter (or perhaps you only license 500 users to start). The cost difference is huge. Present this internally: “If we accept Copilot at least for everyone, it’s $X; if we follow the benchmark trend (pilot program, phased rollout), it’s $Y. We should negotiate toward the $Y scenario.” This helps leadership understand why you might resist Microsoft’s push to blanket-deploy the shiny new thing. It ties back to avoiding shelfware and overcommitment: by modeling a smaller, benchmark-aligned adoption of Copilot, you can save significantly and still derive value. In short, even without exact benchmark numbers for AI (since it’s new), use whatever intel is available (like percentage discounts or trial lengths other companies got) to shape a more cost-effective adoption plan in your model.

4. Include alternative channel scenarios: As part of modeling, consider a scenario where you don’t renew everything in the EA. For instance, what if you moved a portion of licenses to CSP or a direct MCA subscription? You might lose some EA perks, but maybe you gain flexibility or even cost savings if Microsoft doesn’t discount. Model the financial outcome: perhaps CSP pricing is flat, but you could drop 10% of unused licenses in year 2 (which you can’t easily do in EA). Would that save money compared to being locked in? Some enterprises find that a selective move to CSP for certain workloads could be a leverage point – even if you ultimately keep the EA, knowing that the CSP route is viable at a similar cost puts pressure on Microsoft to match or beat those terms. Use benchmarks here in a qualitative sense: if CSP is priced about the same globally (since Microsoft is aligning EA and CSP pricing), then any added EA cost must be justified by equivalent discount/value. If not, the model might show CSP as cheaper over time.

5. Stress-test Microsoft’s proposal against benchmarks: Another modeling approach is to take Microsoft’s proposed growth assumptions and test if they are realistic compared to industry trends. Microsoft might assume you’ll increase usage of certain services by 20% (hence, they’re pricing things with that in mind). If benchmarks or peer feedback say most companies are actually flattening or trimming their Microsoft spend (perhaps due to optimization or economic pressures), you can question those assumptions. In your scenario planning, plug in lower growth or a plan to optimize licenses (many organizations find 5-10% of licenses are shelfware that can be cut). See how that affects the 3-year cost. This can inform negotiation of things like caps or the ability to reduce licenses. For instance, you might discover “if we can right-size and true-down 10% of licenses by year 2, we save $Z – so let’s negotiate that flexibility, as others have done via CSP or special terms.” Your scenario model thus becomes a tool to argue for contract terms that protect you if reality deviates from Microsoft’s rosy projections.

By modeling various outcomes with benchmark inputs, you turn abstract percentages into concrete dollars. It clarifies what a fair deal versus an inflated deal looks like.

This not only strengthens your resolve in negotiations (you know what you could save), but also provides a rational basis to make tough choices – like walking away from a bad deal or investing in an alternative – if Microsoft won’t meet the market.

Essentially, benchmarks enable data-driven decision making for your EA renewal strategy, which is exactly where CIOs and CFOs want to be.

Industry EA Benchmarks at a Glance

To summarize the discussion, the table below provides a high-level glance at typical Enterprise Agreement benchmarks and trends by industry. Use this as a quick reference for how different sectors stack up:

| Industry | Typical License Mix (E3 vs E5 vs Frontline) | Average Discount Ranges (M365 / Azure) | Common Upsell Pressure Points | Negotiation Opportunities |

|---|---|---|---|---|

| Finance | Heavy E5 adoption (50%+ E5, rest E3; few frontline) for compliance needs. | M365: ~15–25% off Azure: ~20–30% off (with large commits) | E5 security/compliance bundles; Azure cloud for analytics; early AI (Copilot) trials. | Leverage big spend and multi-cloud threats for concessions. Counter “standard” pricing with peer data. Use alternate security tools as fallback to demand E5 discounts. |

| Healthcare | Selective E5 (20–30% E5, majority E3; some F3 for clinical staff). | M365: ~10–20% off Azure: ~10–20% off (if committing) | E5 for specific roles; Azure for data/AI (but often limited); pushing Teams/telehealth features. | Cite budget constraints and peer deals to keep costs down. Pilot new products (AI, etc.) with small groups. Insist on flexibility due to uncertain demand. |

| Manufacturing | Majority E3 with significant Frontline (e.g. 10% E5, 50% E3, 40% F3) across global workforce. | M365: ~10–20% off Azure: ~15–25% off (if IoT/analytics usage) | Upgrading frontline to Teams/Viva; Dynamics 365 or Power Platform integration; E5 for IP protection. | Use large user count as leverage – “meet market price or we consider alternatives at scale.” Negotiate bundle trades (e.g. accept Dynamics if core M365 is cheaper). |

| Tech Sector | High E5 usage (30–50% E5, rest E3; few frontline) with early adoption of add-ons (Copilot, etc.). | M365: ~15–25% off Azure: ~20–30% off (with high cloud spend) | Copilot and AI services enterprise-wide; GitHub or DevOps bundles; premium support tiers. | Emphasize willingness to go elsewhere (or build in-house) if prices aren’t right. Demand pilot programs for AI. Use knowledge of MS licensing to press for best-in-class rates. |

| Public Sector | Mostly E3/G3 with limited E5/G5 (10–20% E5 for high-security agencies); some frontline in education/local gov. | M365: ~5–15% off (standard govt agreements) Azure: 0–20% off (varies widely) | Compliance-focused upsells (G5 security); Cloud for government push (Azure Gov); AI for public services. | Reference other government deals as benchmarks. If part of a consortium, leverage collective bargaining. Push for extra value-add (free periods, added services) to justify spend. |

Notes: These ranges are illustrative based on 2025 market intelligence and may vary by specific deal. Public sector deals can occasionally exceed typical discounts by far when negotiated at a national level (e.g., a free Copilot year in the US federal deal).

In all industries, the upper end of the discount range usually requires strong negotiation and a willingness to leverage alternatives or commit more spending in exchange for savings.

Use this table to sanity-check your own EA proposal. If, for instance, you’re a manufacturer seeing only 5% off on a huge E3 volume, that’s a glaring outlier – time to push back. Or if you’re a tech firm being told 10% off Azure is the best Microsoft can do, yet peers get ~25%, you know there’s room.

Keep in mind, specific circumstances (e.g., a strategic partnership or a particularly weak negotiating posture) can lead to deals outside these norms, but by and large, these figures represent the ballpark of competitive EA deals in 2025 for each sector.

Five Ways to Apply Benchmarks to Reduce EA Costs

Finally, let’s boil it down to actionable tactics. Here are five concrete ways you can use benchmarking to slash your Microsoft EA costs:

- Use Benchmarks as Your Anchor: Before you even engage with Microsoft’s sales team, decide on your target pricing based on benchmark data. Open negotiations with a firm stance anchored to that data. For example, “Our goal is a total program cost of $X, in line with what similar enterprises achieve.” Starting from a market-based anchor (rather than Microsoft’s high quote) shifts the gravity of the deal in your favor. It also signals to Microsoft that you expect a market-aligned outcome, not a one-sided “Microsoft says so” price.

- Challenge the “Industry Norm” Spin: Microsoft negotiators often claim that “Most customers in your industry pay around this price” to make you feel you’re getting a fair shake. Don’t accept such claims at face value – counter with your own data. If Microsoft says 10% off is typical, but your sources show 20% is common, politely challenge them: “We’ve seen otherwise in our benchmarking.” By debunking bogus industry claims with hard facts, you prevent Microsoft from low-balling you under the guise of normalcy. Essentially, you replace anecdotes with evidence, which usually forces Microsoft to improve its offer or at least engage more earnestly.

- Align to Peer Deals, Not List Prices: Always frame your negotiation in terms of discounts off list or cost per unit relative to peers, rather than just haggling off Microsoft’s starting numbers. This mental shift keeps the focus on real-market prices. Internally, it helps to produce reports showing “peer-aligned price vs. our quote” – this keeps everyone focused on the right benchmark. When Microsoft sees that you measure success by how your deal stacks up to others (and that you’re willing to walk if it’s an outlier), they are far more likely to cut fat from the proposal. In short, make the peer benchmark the true north of the negotiation, not Microsoft’s inflated list price.

- Leverage Alternative Channels if Needed: Benchmarks might reveal that CSP or MCA-E pricing and terms are effectively more favorable if Microsoft doesn’t match a certain discount. Be willing to use this. For instance, “If you can’t hit a 20% discount, we may transition these workloads to a CSP agreement where we have flexibility to optimize costs.” Even if you prefer to stick with an EA, the credible threat of taking some business elsewhere (or splitting the deal) can spur Microsoft to sharpen its pencil. Many organizations in 2025 are doing exactly this – they show Microsoft that the old lock-in is over. If Microsoft refuses to meet benchmarked pricing, you can increasingly mix and match: maybe keep core licenses in EA but move peripheral ones to monthly subscriptions until Microsoft comes around. This tactic not only saves money directly but also strengthens your hand for the next EA cycle.

- Continuously Update and Track Benchmarks: Don’t treat benchmarking as a one-time task just for this renewal. The market moves fast – Microsoft’s pricing strategies evolve (often not in customers’ favor), and what was a good discount three years ago might be mediocre today. Make it a practice to regularly gather new benchmark data, whether through consultants, peer groups, or market research. Track how discount levels change over time and use that intel in mid-term or future negotiations. For example, if the last EA you got 15% off and you see the average is now 18%, you know not to settle for 15% again. By staying current, you ensure you never accept yesterday’s deal as good enough today. Microsoft constantly adjusts its pricing tactics; you should adjust your benchmarks accordingly. This ongoing approach means that with each renewal, you’re raising the bar and keeping Microsoft honest, rather than complacently rolling over contracts.

By applying these five strategies, you’ll make benchmarking an embedded part of your EA negotiation playbook.

The overall theme is proactivity and fact-based negotiation: no more guessing, no more accepting “trust us” – you bring the receipts (literally).

Companies that embrace this approach have been able to secure significantly better EA terms, cut out unnecessary spend, and drive accountability on Microsoft’s side to earn their business at a fair price.

FAQs

Q: What industries typically get the best EA discounts?

A: It largely depends on leverage and spend, but we see financial services and large tech firms often securing the deepest EA discounts. These industries typically have significant Microsoft investments and skilled negotiation teams, so discounts of 20% or more on major products are common. They’re also more likely to pit Microsoft against competitors or alternatives (multi-cloud, Google, etc.), which forces bigger concessions. That said, any large enterprise with a competitive mindset can achieve great discounts – for example, even a government deal, when aggregated, resulted in extremely steep discounts (the US federal OneGov agreement saved an unprecedented $3 billion+ with freebies like a year of Copilot at no cost). So “best discounts” come to those who prepare best, but finance and tech tend to lead the pack. Public sector and healthcare often have moderate pre-set discounts unless they undertake special negotiations. Manufacturing falls somewhere in the middle – big volumes but tighter margins mean they push for savings too. In essence, the best discounts go to those who demonstrate they won’t overpay, which any industry can do with the right approach, though finance and tech have made an art of it.

Q: How can benchmarks help me prepare for an EA renewal?

A: Benchmarks are your preparation secret weapon. First, they let you set realistic targets – you can budget and plan negotiations around what a fair price should be, rather than Microsoft’s opening number. This prevents sticker shock and over-budget surprises. Second, benchmarks inform your negotiation strategy: you’ll know which parts of your deal are priced high and need the most focus. You can prioritize, say, pushing on that Azure commit or that Office 365 line item that’s above market. Third, benchmarks strengthen your internal case – you can show executives “here’s what we should be paying; if we don’t get it, we have a problem.” Finally, they boost your confidence with Microsoft. Instead of going in unsure of what to ask for, you go in armed with facts: “Similar companies pay 20% less – we expect that treatment.” This often changes Microsoft’s tone, as they realize you’re negotiating with evidence, not just hope. In summary, benchmarks make your renewal prep smarter and your outcomes better by replacing guesswork with data-driven planning.

Q: Are Copilot prices negotiable at this stage?

A: Yes – but it depends on your clout and approach. Officially, Microsoft touts Copilot at a flat $30/user/month with no standard discounts. Unofficially, we’re already seeing negotiable elements. Large enterprises and strategic customers have snagged significant Copilot discounts (10–40%) or trial periods as part of their EAs. For instance, some got several months free or a lower per-user price in exchange for being a reference customer. Even the government got a special deal (a free year for G5 users). If you’re a smaller customer, Microsoft may not budge on Copilot’s price yet – demand is high and it’s early. However, if Copilot is a “nice to have” for you, it’s worth negotiating: Microsoft might offer a pilot program or phased rollout pricing rather than lose the opportunity. We recommend treating Copilot like any new upsell – express interest, but make it contingent on terms that align with value. Ask for things like a pilot discount, the ability to start with a subset of users, or even the option to cancel if it doesn’t meet expectations. Microsoft may resist, but as other customers’ experiences become benchmarks (e.g., how many actually deployed Copilot enterprise-wide), you’ll gain more leverage. In short, Copilot can be negotiable, especially for larger deals – don’t be afraid to try, and use whatever early benchmark info you can (“some clients are getting deals”) as leverage.

Q: Do benchmarks vary by geography as well as industry?

A: Absolutely. Microsoft’s pricing may vary by region due to currency fluctuations, local market conditions, or regional promotions. For example, European customers saw price adjustments in recent years as Microsoft “aligned” currency pricing, which in practice meant price hikes in some regions. So a benchmark from a U.S. deal might not directly apply in, say, APAC or Europe without adjustment. It’s best to gather benchmark data that’s region-specific when possible. That said, with Microsoft moving to more global uniform pricing (like the upcoming single-level pricing), some regional differences are narrowing. Still, be aware of local factors: government customers in one country might have unique discounts, or certain industries in emerging markets might get special programs. If your company operates in multiple geographies, look at benchmarks in each – you might find your European subsidiary got a different discount than your U.S. office, for instance. Use that information in negotiations (“our EMEA division got X%, we expect similar here”). In summary, yes, benchmarks do vary by geography, and a savvy negotiator accounts for those differences – ideally arming themselves with regional benchmark insights alongside industry ones.

Q: How do I know if my EA renewal quote is above market?

A: The telltale sign is when the discounts in your quote are smaller (or the per-user costs higher) than those achieved by comparable organizations. If you’ve done your homework on benchmarks, compare line by line. For example, if you have 10,000 employees and you’re offered only 5% off M365 E3, but you know companies of that size usually get 15% or more, your quote is above market. Another hint: Microsoft’s first proposal is almost always above market – it’s safe to assume it’s high unless proven otherwise. Look for specific red flags: Is the annual price increase baked into your quote higher than normal? (Many enterprises negotiate 0–5% annual uptick; if Microsoft baked in 10%, that’s high.) Is Microsoft quoting you for licenses you don’t actually need or use (which inflates your cost)? Above-market can also appear in the fine print: maybe your quote lacks a price lock, but peers got one, meaning your long-term cost could soar. A practical step is to ask third-party advisors or peers to review the quote – they’ll quickly spot if something is off. In short, you know it’s above market if the deal metrics fall outside the prevailing range that well-informed customers are getting. That’s why having current benchmark data is so crucial – without it, you’re guessing. With it, you can say with confidence, “This renewal is coming in high and we can do better,” then go back to Microsoft and negotiate precisely where it’s out of line.

Read about our Microsoft Negotiation Services.